[ad_1]

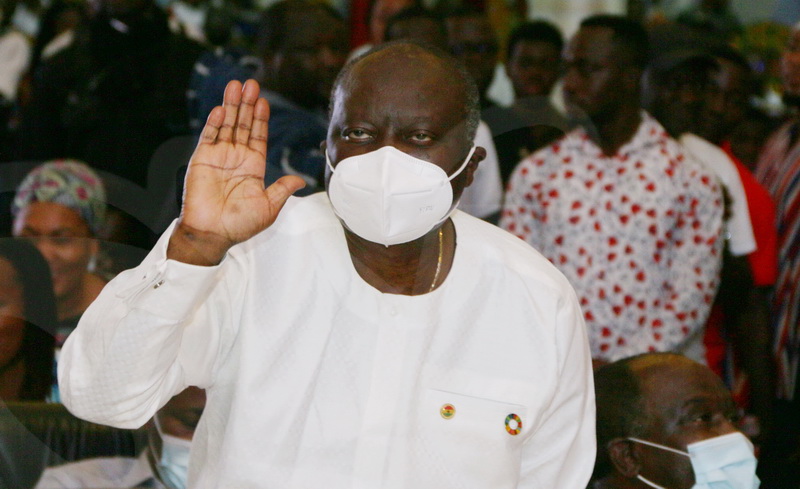

Finance Minister, Ken Ofori-Atta has ruled out any move to conduct another round of Domestic Debt Exchange Programme (DDEP) targeted at Pension Funds.

He made the statement in reaction to reports suggesting that the Finance Ministry has assured Eurobond investors of another round of DDEP during a virtual engagement.

“We are not planning a second round of the domestic debt echange programme for pension funds. I think it was a misunderstanding”, he explained at News Conference in Washington DC.

Mr. Ofori-Atta stated that the presentation was taken out of contest when he proffered an explanation to the investors.

He recalled that government has already reached an agreement with organised labour not to include pension funds, a situation that remains same.

“We reached an agreement with organised labor association that pension funds were exempted. That has not changed”.

Government secures ¢82.9bn in DDEP,

In February, the Ministry of Finance announced that approximately 85% of bondholders participated in the DDEP.

This amounted to ¢82,994,510,128 (¢82.99 billion)

“The Government is pleased with the results, as a substantial majority of the Eligible Holders have tendered,” a statement from the ministry said.

It added that the result is a significant achievement for the government to implement fully the economic strategies in the post-COVID-19 Programme for Economic Growth (PC-PEG) during the current economic crisis.

To provide sufficient time to settle the New Bonds in an efficient manner, the statement explained that government is extending the Settlement Date of the Exchange from the previously announced February 14, 2023 to February 21, 2023.

“This Settlement Date extension is, however, only to process the settlement of the New Bonds. The issue date, interest accrual schedules and payment schedules for the New Bonds will be adjusted to reflect the actual Settlement Date”.

It added that as the exchange period has expired, no new tenders will be accepted, and no revocations or withdrawals will be permitted

DISCLAIMER: The Views, Comments, Opinions, Contributions and Statements made by Readers and Contributors on this platform do not necessarily represent the views or policy of Multimedia Group Limited.

[ad_2]

Source link